The Startup India Seed Fund Scheme is a game-changer for Indian entrepreneurs, providing financial assistance to nurture innovative ideas and transform them into successful startups. Learn about the scheme, its benefits, and how to apply in this comprehensive guide.

Introduction:

The Indian startup ecosystem has been growing rapidly, with numerous innovative ideas and solutions emerging from every corner of the country. To further accelerate this growth, the Government of India launched the Startup India Seed Fund Scheme (SISFS) in 2021, providing financial assistance to startups in their early stages. This article delves into the details of the SISFS, shedding light on its objectives, benefits, and application process

In India, the burgeoning startup ecosystem is brimming with promising ventures brimming with potential. However, access to initial funding can often be a significant hurdle for these nascent businesses. Recognizing this challenge, the Government of India established the Startup India Seed Fund Scheme (SISFS) – a game-changer for early-stage startups.

This article delves into the intricacies of the SISFS, equipping aspiring entrepreneurs with the knowledge to leverage this scheme and propel their ventures toward growth.

What is the Startup India Seed Fund Scheme?

The SISFS is a government initiative launched in 2018 to provide financial assistance to startups in their initial stages. It aims to bridge the funding gap and foster a vibrant startup ecosystem in India.

The scheme operates through accredited incubators and funds recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) https://dpiit.gov.in/. These entities act as intermediaries, evaluating startup applications and disbursing funds.

Key Features

The SISFS offers several attractive features to incentivize early-stage startups:

- Funding Amount: Startups can receive funding between INR 50 lakh (US$66,000) and INR 10 crore (US$1.3 million) to cover expenses like product development, prototyping, market validation, and team building.

- Equity-free Funding: Unlike venture capitalists, the SISFS provides grants, eliminating the need for startups to relinquish equity. This allows entrepreneurs to retain ownership and control over their ventures.

- Stage-agnostic Support: The scheme caters to startups in their idea, prototype, or early revenue stages, making it highly inclusive.

- Focus on Innovation: SISFS prioritizes innovative startups with the potential for high growth and job creation.

Objectives

The primary objectives are:

- To provide financial assistance to startups in the form of grants, enabling them to develop their ideas and transform them into viable businesses.

- To create a robust startup ecosystem that supports innovation encourages entrepreneurship, and fosters job creation.

- To bridge the funding gap between the seed and growth stages, ensuring that startups have the necessary resources to scale their operations.

Eligibility Criteria

To qualify for the SISFS, startups must meet the following criteria:

- Registration: The startup must be registered as a Private Limited Company or a Limited Liability Partnership (LLP) in India.

- Age of the Startup: The startup should not be older than five years from the date of its incorporation.

- Innovation: The business idea must be innovative and have the potential to disrupt existing markets or create new ones.

- Scalability: The startup should have a scalable business model with the potential for rapid growth.

- Registration with DPIIT: The startup must be registered on the Startup India portal https://www.startupindia.gov.in/content/sih/en/startup-scheme.html.

The Application Process

The application process for the SISFS is generally conducted through accredited incubators or funds:

- Identify an Accredited Incubator/Fund: Research and identify an incubator or fund recognized by the DPIIT that aligns with your industry and investment focus.

- Develop a Compelling Application: Prepare a comprehensive application outlining your business plan, market opportunity, team expertise, financial projections, and how the funding will be utilized.

- Submit the Application: Submit your application to the chosen incubator/fund, adhering to their specific deadlines and requirements.

- Evaluation and Selection: The incubator/fund will assess your application based on pre-defined criteria and shortlist promising startups for further scrutiny.

- Pitch Presentation: If shortlisted, you will have the opportunity to present your business idea to a panel comprising representatives from the incubator/fund and potentially, investors.

- Fund Disbursement: Upon successful selection, the incubator/fund will disburse the approved funding amount to your startup in tranches based on pre-determined milestones.

Benefits of Applying

The SISFS offers a plethora of benefits to early-stage startups:

- Financial Support: The scheme provides crucial funds to cover initial expenses, enabling startups to validate their ideas and build a strong foundation for growth.

- Mentorship and Guidance: Accredited incubators/funds often provide valuable mentorship and guidance to startups on various aspects of business development.

- Network Building: The scheme connects startups with potential investors, industry experts, and other stakeholders, fostering valuable networking opportunities.

- Increased Credibility: Receiving funding through the SISFS enhances a startup’s credibility, attracting further investments and partnerships.

Considerations Before Applying

While the SISFS presents a compelling opportunity, there are some crucial aspects to consider before applying:

- Competition: The scheme attracts a large pool of promising startups. Ensure your business idea is truly innovative and has a strong value proposition to stand out.

- Selection Criteria: Thoroughly understand the selection criteria of your chosen incubator/fund and tailor your application to address those specific requirements.

- Focus on Milestones: Clearly define achievable milestones for utilizing the funds. This demonstrates a well-defined plan and responsible use of resources.

- Long-Term Vision: The SISFS is intended to be a springboard for future funding. Have a clear vision for how you’ll leverage the initial funding to attract further investments and achieve sustainable growth.

- Alignment with Incubator/Fund: Select an incubator/fund that aligns with your industry and investment focus. Their expertise and network can significantly benefit your startup’s journey.

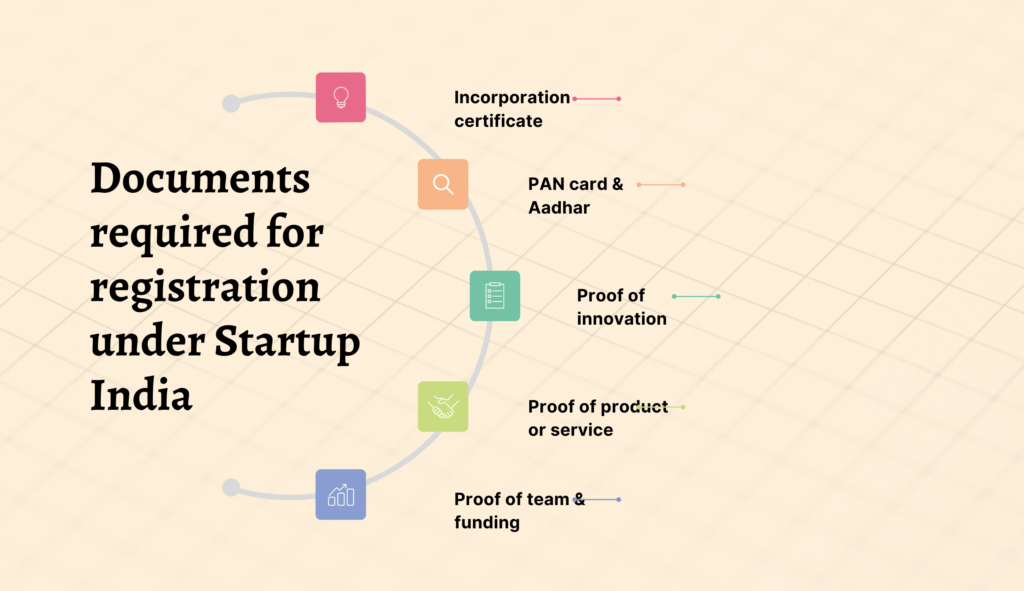

Required Documents

The documents required to apply for this Scheme (SISFS) aren’t directly submitted to the government agency DPIIT. Instead, they are submitted to the incubator or fund you choose to apply through. However, there are some general requirements:

- Startup Registration Documents: A copy of your startup’s certificate of incorporation (as a Private Limited Company or LLP) will be mandatory.

- DPIIT Recognition Certificate: If your startup is already recognized by DPIIT, having this certificate will strengthen your application.

- Application Portal Login Details: You’ll likely need to provide your login credentials for the Startup India portal to allow verification of your registration.

- Basic Contact Information: An active mobile number and email address for your startup will be necessary for communication.

- Aadhar Card and PAN Card

Beyond these essentials, the specific documents required will depend on the chosen incubator/fund’s application process. They might request additional information such as:

- Business Plan: A comprehensive document outlining your business idea, market opportunity, target audience, competitive landscape, revenue model, and financial projections.

- Team Profiles: Information about your team’s experience, skills, and qualifications to demonstrate your capabilities of executing the plan.

- Pitch Deck: A concise presentation summarizing your business idea, value proposition, and funding requirement to capture the interest of the incubator/fund.

- Financial Statements (if available): Any existing financial statements can provide transparency on your startup’s financial health (if applicable).

Frequently Asked Questions (FAQs)

Is there a minimum funding amount provided under the SISFS?

No, the funding amount is distributed based on the startup’s needs and the incubator/fund’s evaluation. However, it typically falls within the range of INR 50 lakh to INR 10 crore.

Does the SISFS require any collateral for the funding?

No, the SISFS is an equity-free grant scheme. You won’t be required to provide any collateral for the funding received.

Can a startup apply to multiple incubators/funds under the SISFS?

Yes, a startup can apply to a maximum of three incubators/funds simultaneously to increase their chances of selection.

What happens if my startup is not selected for funding under the SISFS?

If unsuccessful, seek feedback from the incubator/fund to understand areas for improvement. Explore alternative funding options like angel investors, venture capitalists, or bank loans.

Where can I find more information about the SISFS?

You can access detailed information and application guidelines on the Startup India portal https://www.startupindia.gov.in/content/sih/en/startup-scheme.html and the DPIIT website https://dpiit.gov.in/.

Conclusion

The Startup India Seed Fund Scheme stands as a testament to the Indian government’s commitment to fostering a thriving startup ecosystem. The SISFS empowers early-stage ventures to translate their innovative ideas into successful businesses by providing crucial financial support, mentorship, and networking opportunities.

For aspiring entrepreneurs in India, the SISFS presents a valuable launchpad to propel their ventures towards growth and contribute to the nation’s economic development. Carefully consider the eligibility criteria, application process, and essential considerations before embarking on your journey with the SISFS. With a well-defined plan, a compelling business idea, and the support of this scheme, you can transform your entrepreneurial dream into a thriving reality.

Read More: Pradhan Mantri Kaushal Vikas Yojana (PMKVY)