Sukanya Samriddhi Yojana is a government scheme to secure the future of the girl child. Learn about eligibility, benefits, and how to invest in this beneficial scheme.

Introduction

In India, the birth of a girl child is a celebration. The Sukanya Samriddhi Yojana (SSY) is a government program that echoes this sentiment. Launched in 2015, it’s a special deposit scheme designed to empower and secure the future of the girl child.

This article provides a comprehensive overview of the Sukanya Samriddhi Yojana, including its benefits, eligibility criteria, investment options, and frequently asked questions.

What is Sukanya Samruddhi Yojana?

The Sukanya Samruddhi Yojana is a government-backed savings scheme that allows parents or legal guardians to open an account in the name of their girl child. The account can be opened at any time from the birth of the girl child until she attains the age of 10 years. The account can be opened at any post office or authorized bank branch.

How it Works:

- Account Opening: The account can be opened by filling out the application form available at post offices or bank branches. Required documents include the girl child’s birth certificate and identity proof of the depositor.

- Deposit: A minimum initial deposit of ₹250 is required, with subsequent deposits in multiples of ₹100 up to a maximum of ₹1.5 lakh per year.

- Operation: The girl child can operate the account after reaching the age of 10.

- Withdrawal: Partial withdrawals are allowed for higher education expenses after the girl turns 18, and the account matures after 21 years from the opening date or at the time of the girl’s marriage after turning 18.

- Closure: Premature closure is allowed after five years on compassionate grounds like life-threatening diseases, with the account earning interest at the Post Office Savings Bank rate.

The Sukanya Samriddhi Yojana aims to empower parents to save for their daughter’s future education and marriage, providing a secure financial foundation for the girl child.

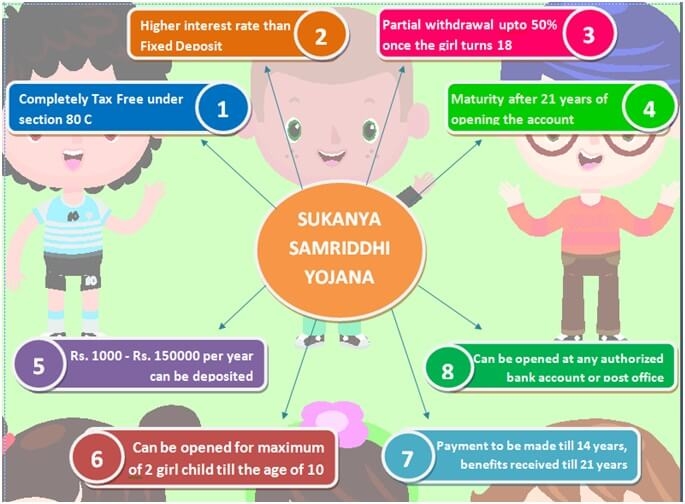

Benefits of Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana offers numerous advantages for parents and guardians of girl children. Here are some key benefits:

- Attractive Interest Rates: The SSY offers one of the highest interest rates among government savings schemes in India. Currently, the interest rate is set at 7.6% (as of May 21, 2024).

- Tax Benefits: Deposits made towards the Sukanya Samriddhi Account qualify for tax deductions under Section 80C of the Income Tax Act, 1961. This helps reduce your taxable income and potentially save on taxes.

- Long-Term Security: The SSY account matures after 21 years from the date of account opening or upon the girl child’s marriage after she attains 18 years of age, whichever is earlier. This ensures a substantial corpus for the girl’s future needs like education or wedding.

- Partial Withdrawals: Partial withdrawals can be made from the Sukanya Samriddhi Account after the girl child turns 18 years old, for financing her higher education.

- Account Replicability: The SSY scheme allows parents or guardians to open multiple accounts for two or more girl children in their family.

- Easy Account Opening: The Sukanya Samriddhi Account can be conveniently opened at any post office or designated branches of authorized banks.

Eligibility for Sukanya Samriddhi Yojana

To be eligible for the Sukanya Samriddhi Yojana (SSY), the following criteria must be met:

- The account can only be opened by the parents or legal guardians of the girl child.

- The scheme is available for birth or adoption of a girl child.

- The girl child must be below the age of 10 years at the time of account opening.

- Only one account is allowed per girl child. However, in case of twins or triplets, a separate account can be opened for each girl child.

- A maximum of two accounts are permissible for two different girl children in a family, opened by their natural or legal guardian. An exception for a third account is made in cases of twins being born in the second instance or if the first birth results in three girl children upon presenting a medical certificate from a qualified medical authority.

- The account beneficiary must be an Indian citizen and resident in India at the time of account opening and must continue to be so until the account reaches maturity or is closed.

- The minimum deposit to open the account is ₹250, and the maximum deposit allowed in a financial year is ₹1.5 lakh.

By meeting these eligibility criteria, parents or legal guardians can open a Sukanya Samriddhi Yojana account to secure the financial future of their girl child.

Investment in Sukanya Samriddhi Yojana

To apply for the Sukanya Samriddhi Yojana, you can follow these general steps based on the information provided in the sources:

- Check Eligibility: Ensure that the girl child is below the age of 10 years, as this is a key eligibility criterion for opening a Sukanya Samriddhi Yojana account.

- Gather Required Documents: Collect the necessary documents such as the girl child’s birth certificate, parent or legal guardian’s photo ID, address proof, and a photograph of both the child and the parent or guardian.

- Visit Post Office or Bank: Visit the nearest post office or authorized bank branch that offers the Sukanya Samriddhi Yojana scheme.

- Fill Application Form: Obtain and fill out the Sukanya Samriddhi Yojana account opening form with accurate and complete details.

- Submit Application: Attach the required documents to the application form and submit them to the post office or bank staff at the designated counter.

- Pay Initial Deposit: Make the initial deposit amount, which is a minimum of ₹250, to open the Sukanya Samriddhi Yojana account.

- Receive Account Passbook: After processing your application, the post office or bank will provide you with a Sukanya Samriddhi Yojana account passbook.

- Operate the Account: The account can be operated by the parents or legal guardians until the girl child reaches the age of 18, after which she can operate the account herself.

- Make Regular Contributions: Ensure to make regular contributions to the account to keep it active and maximize the benefits offered by the scheme.

- Utilize Benefits: Take advantage of the high-interest rate, tax benefits, and flexibility in withdrawals offered by the Sukanya Samriddhi Yojana to secure the financial future of the girl child.

Remember, specific procedures and requirements may vary slightly depending on the institution where you choose to open the Sukanya Samriddhi Yojana account. It is advisable to contact the respective post office or bank for detailed guidance on the application process.

Required Documents

To open a Sukanya Samriddhi Account, you will need the following documents:

- Application form for Sukanya Samriddhi Account (available at the bank or post office)

- Birth certificate of the girl child

- KYC documents of the guardian (proof of identity and address)

- Two passport-sized photographs of the girl child

Interest Rate and Maturity Period

The current interest rate offered on the Sukanya Samriddhi Account is 7.6% (as of May 21, 2024). The account matures after 21 years from the date of account opening or upon the girl child’s marriage after she attains 18 years of age, whichever is earlier.

Premature Closure of Sukanya Samriddhi Account

The Sukanya Samriddhi Account can be closed prematurely only under specific circumstances, such as the death of the girl child or the account holder. In such cases, the maturity amount payable will be the balance in the account along with accrued interest up to the date of closure.

Tax Implications of Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana offers significant tax benefits. Here’s a breakdown:

- Deposits made towards the Sukanya Samriddhi Account qualify for a tax deduction under Section 80C of the Income Tax Act, 1961. This allows you to reduce your taxable income and potentially save on taxes. The maximum deduction allowed under Section 80C is Rs.1.5 lakhs per financial year (as of May 21, 2024).

- Interest earned on the Sukanya Samriddhi Account is taxable as per the income tax slab of the account holder (typically the girl child after she turns 18).

- Maturity amount received from the Sukanya Samriddhi Account is completely tax-free.

Loan Facility against Sukanya Samriddhi Account

Currently, there is no loan facility available against the Sukanya Samriddhi Account. However, partial withdrawals can be made to finance the girl child’s higher education after she turns 18 years old.

Who can be the Account Holder in Sukanya Samriddhi Yojana?

The account for the girl child can be jointly held by the parent or legal guardian. The girl child becomes the sole account holder upon attaining 18 years of age.

Things to Consider before Investing in Sukanya Samriddhi Yojana

While the Sukanya Samriddhi Yojana offers numerous benefits, here are some points to consider before investing:

- Long-Term Commitment: The Sukanya Samriddhi Account has a long lock-in period of 21 years. This means you cannot withdraw the entire amount before maturity except under special circumstances.

- Investment Limit: The maximum annual investment limit is Rs.1.5 lakhs. This might not be enough for some families depending on their long-term financial goals for the girl child.

- Tax Implications of Interest: The interest earned on the Sukanya Samriddhi Account is taxable as per the income tax slab of the account holder (typically the girl child).

what is the process for premature withdrawal?

The process for premature withdrawal of the Sukanya Samriddhi Yojana involves specific conditions and steps as outlined in the sources provided:

- Conditions for Premature Withdrawal:Premature withdrawal can be made after 5 years of opening the account under certain conditions

- Process for Premature Withdrawal:Submit an application in Form-3 for withdrawal, accompanied by documentary proof, for the purpose of education of the account holder

By following these steps and meeting the specified conditions, account holders can initiate the process for premature withdrawal of the Sukanya Samriddhi Yojana account

what is the penalty for premature withdrawal of sukanya samruddhi yojana

here is no direct penalty for premature withdrawal of the Sukanya Samriddhi Yojana account. However, certain conditions and restrictions apply:

- Partial withdrawal is allowed after the girl child turns 18 years old, for the purpose of higher education. Up to 50% of the balance at the end of the preceding financial year can be withdrawn.

- Premature closure of the account is allowed in the following cases:

- After 5 years from the date of account opening, if the account holder is getting married and will be at least 18 years old at the time of marriage.

- On medical grounds if the account holder is diagnosed with a life-threatening disease.

- In case of the death of the account holder or the guardian.

- No premature closure is allowed before 5 years from the date of account opening.

- If an account is discontinued due to non-payment of the minimum annual deposit, it can be regularized by paying a penalty of ₹50 per year of default along with the minimum deposit for the defaulted years, before the completion of 15 years from the date of account opening.

So in summary, while there is no direct penalty for premature withdrawal, certain conditions and restrictions apply based on the age of the account holder and the reason for withdrawal. Closure before 5 years is not allowed at all.

maximum amount that can be prematurely withdrawn

The maximum amount that can be prematurely withdrawn from the Sukanya Samriddhi Yojana account is up to 50% of the balance available at the end of the previous financial year. This withdrawal can be made in one lump sum or in installments, not exceeding one per year, for a maximum of five years, subject to the specified ceiling and the actual requirement for fees or other charges related to education or marriage purposes

Conclusion

The Sukanya Samriddhi Yojana is a commendable initiative by the Government of India to promote girl child education and financial security. With its attractive interest rates, tax benefits, and long-term security, it provides a valuable financial tool for parents and guardians to secure the future of their daughters.

FAQs (Frequently Asked Questions)

Who can open a Sukanya Samriddhi Account?

A parent or legal guardian can open an SSY account for a girl child below 10 years of age.

How many accounts can be opened under SSY?

Up to two accounts can be opened for two girl children in a family.

What is the minimum and maximum investment amount?

The minimum annual deposit is Rs.250, and the maximum is Rs.1.5 lakhs per financial year.

When can I withdraw money from the SSY account?

A: Partial withdrawals can be made after the girl child turns 18 years old for financing her higher education. The entire amount can be withdrawn upon account maturity or the girl child’s marriage after she turns 18 (whichever is earlier).

Is there a penalty for not maintaining the minimum balance?

A: A penalty of Rs.50 is applicable if the minimum balance of Rs.250 is not maintained in a financial year.

By understanding the benefits, eligibility criteria, and investment options of the Sukanya Samriddhi Yojana, you can make an informed decision about whether it’s the right investment for your daughter’s future.

Read More: Atal Pension Yojana (APY)