The Stand Up Mitra Scheme empowers SC/ST and women entrepreneurs in India by facilitating bank loans. This guide explores eligibility, application process, and benefits.

The Stand Up Mitra Scheme is a government-backed initiative in India that aims to empower small businesses and entrepreneurs by providing them with access to financial resources and mentorship support. Launched in 2016, this scheme is part of the broader “Stand Up India” program, which was introduced to promote entrepreneurship and job creation across the country.

What is Stand Up Mitra Scheme

The Stand Up Mitra Scheme is a government initiative that aims to facilitate bank loans between ₹10 lakh and ₹1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch. This scheme is designed to promote entrepreneurship among women, Scheduled Caste (SC), and Scheduled Tribe (ST) individuals by providing financial assistance for setting up greenfield enterprises in manufacturing, services, agri-allied activities, or the trading sector.

The Stand Up Mitra Scheme is part of the broader Stand-Up India program launched by the Government of India to support entrepreneurship and job creation, particularly among marginalized communities like SC, ST, and women entrepreneurs. Applicants can apply for loans under this scheme directly at the bank branch, through the Stand-Up India portal, or via the Lead District Manager (LDM)

The Objectives of the Stand Up Mitra Scheme

The primary objectives of the Stand Up Mitra Scheme are:

- Financial Assistance: To provide easy access to credit and financial support to small businesses and entrepreneurs, particularly those from the Scheduled Caste (SC), Scheduled Tribe (ST), and Women categories.

- Mentorship and Guidance: To offer mentorship and guidance to help small businesses and entrepreneurs navigate the challenges of starting and growing their ventures.

- Skill Development: To facilitate skill development and training programs to enhance the capabilities of small business owners and entrepreneurs.

- Promoting Entrepreneurship: To encourage and promote entrepreneurship, especially among the underserved sections of society, as a means of creating employment and driving economic growth.

Eligibility Criteria for the Stand Up Mitra Scheme

The Stand Up Mitra Scheme is open to the following categories of individuals:

- Scheduled Caste (SC) and Scheduled Tribe (ST) Individuals: Individuals belonging to the Scheduled Caste (SC) or Scheduled Tribe (ST) communities who wish to set up a greenfield enterprise in manufacturing, services, or the trading sector.

- Women Entrepreneurs: Women entrepreneurs who wish to set up a greenfield enterprise in manufacturing, services, or the trading sector.

- Individuals: Individuals who do not belong to the SC, ST, or Women categories but wish to set up a greenfield enterprise in manufacturing, services, or the trading sector.

To be eligible for the scheme, applicants must meet the following criteria:

- The proposed enterprise should be a greenfield project, meaning it should be a new business venture and not an existing one.

- The loan amount should be between ₹10 lakh and ₹1 crore.

- The applicant should not have availed of any other government subsidy or benefit for the same project.

Benefits of the Stand Up Mitra Scheme

The Stand Up Mitra Scheme offers several benefits to small businesses and entrepreneurs, including:

- Financial Assistance: Eligible applicants can avail of loans ranging from ₹10 lakh to ₹1 crore at concessional interest rates.

- Collateral-free Loans: The loans provided under the scheme are collateral-free, making it easier for small businesses and entrepreneurs to access credit.

- Mentorship and Handholding: Successful applicants are provided with mentorship and handholding support to help them navigate the challenges of starting and growing their businesses.

- Skill Development: The scheme includes skill development and training programs to enhance the capabilities of small business owners and entrepreneurs.

- Promotion of Entrepreneurship: The Stand Up Mitra Scheme aims to promote entrepreneurship, especially among the underserved sections of society, as a means of creating employment and driving economic growth.

How to Apply for the Stand Up Mitra Scheme

Here are the steps to apply for the Stand Up Mitra Scheme:

- Identify a Participating Bank: The scheme is implemented through various public and private sector banks in India. Applicants need to identify a participating bank and approach them for the loan application.

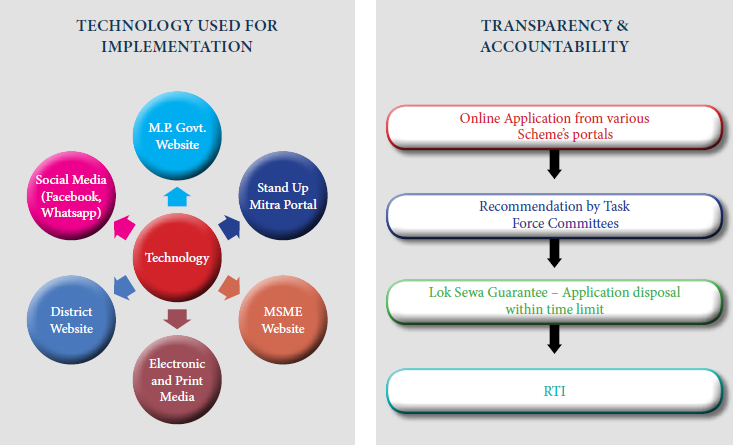

- Submit the Application: Applicants need to submit the required documents, including a detailed project report, financial statements, and proof of identity and address, to the participating bank. The application form can be downloaded from the Stand Up Mitra portal (www.standupmitra.in) or the Stand Up India portal .

- Evaluation and Approval: The bank will evaluate the application and, if approved, will provide the loan and other support services under the scheme.

- Mentorship and Handholding: Successful applicants will be provided with mentorship and handholding support to help them navigate the challenges of starting and growing their businesses.

Alternatively, applicants can also apply for the scheme:

- Directly at the bank branch

- Through the Stand Up India portal (www.standupmitra.in)

- Through the Lead District Manager (LDM)

The scheme aims to encourage all bank branches to extend loans to eligible applicants, including Scheduled Caste (SC), Scheduled Tribe (ST), and women entrepreneurs, for setting up greenfield enterprises in manufacturing, services, or trading sectors

Required Documents:

To apply for the Stand Up Mitra Scheme, the following documents are required:

- Duly filled application form with passport-sized photographs

- Identity Proof: Passport, driving license, voter’s ID card, PAN card

- Proof of Residence: Recent telephone bills, electricity bill, property tax receipt, passport, voter’s ID card

- Proof of Business Address

- Proof that the applicant is not a defaulter in any Bank / Financial Institution

- Memorandum and articles of association of the Company / Partnership Deed of partners

- Assets and liabilities statement of promoters and guarantors along with latest income tax returns

- Rent Agreement (if business premises on rent) and clearance from pollution control board if applicable

- SSI / MSME registration (if applicable)

- Projected balance sheets for the next two years in case of working capital limits and for the period of the loan in case of term loan

- Photocopies of lease deeds/ title deeds of all the properties being offered as primary and collateral securities

- Documents to establish whether the applicant belongs to SC/ST Category, wherever applicable

- Certificate of incorporation from ROC to establish whether majority stake holding in the company is in the hands of a person who belongs to SC/ST/Woman category

For cases with exposure above ₹25 Lakhs, additional documents like profile of the unit, last three years balance sheets of the Associate / Group Companies, and a detailed project report are required

FAQ

Who can apply for the Stand Up Mitra Scheme?

The scheme is open to individuals belonging to the Scheduled Caste (SC), Scheduled Tribe (ST), and Women categories, as well as individuals who do not belong to these categories but wish to set up a greenfield enterprise.

What is the loan amount available under the scheme?

The loan amount under the Stand Up Mitra Scheme ranges from ₹10 lakh to ₹1 crore.

Are the loans provided under the scheme collateral-free?

Yes, the loans provided under the Stand Up Mitra Scheme are collateral-free.

What kind of support is provided under the scheme?

The scheme provides financial assistance, mentorship and handholding support, and skill development programs to help small businesses and entrepreneurs succeed.

How can I apply for the Stand Up Mitra Scheme?

Applicants need to identify a participating bank, submit the required documents, and go through the evaluation and approval process.

how long does it take to get a response after applying for the stand-up Mitra scheme?

After applying for the Stand Up Mitra Scheme, the response time can vary depending on the evaluation process conducted by the bank. Typically, applicants can expect to receive a response within a reasonable timeframe after submitting their application and required documents. The scheme aims to provide timely assistance to eligible individuals, and the exact duration for receiving a response may vary based on the specific circumstances of each application and the processing timelines of the participating bank.

Conclusion

The Stand Up Mitra Scheme is a valuable government initiative that aims to empower small businesses and entrepreneurs in India. By providing financial assistance, mentorship support, and skill development programs, the scheme helps to create a more inclusive and vibrant entrepreneurial ecosystem in the country. If you are a small business owner or an aspiring entrepreneur, the Stand Up Mitra Scheme could be a valuable resource to help you achieve your goals.

Read More: PM Fasal Bima Yojana (PMFBY) 2024