Learn about the PM Fasal Bima Yojana (PMFBY) 2024, a government scheme designed to provide financial assistance to farmers in case of crop failure due to natural calamities. Understand the benefits, eligibility, and application process of this initiative aimed at supporting India’s agricultural sector.

The Indian agricultural sector is highly susceptible to natural calamities such as droughts, floods, and cyclones, which can result in significant crop losses for farmers. To mitigate these risks and provide financial assistance to farmers, the Government of India launched the Pradhan Mantri Fasal Bima Yojana (PMFBY) in 2016. This scheme is a crucial initiative aimed at supporting the agricultural sector, which is the backbone of India’s economy.

Indian agriculture is the backbone of the nation’s economy, but it’s also highly vulnerable to natural calamities and unforeseen events. Crop failure due to floods, droughts, pests, or diseases can devastate a farmer’s livelihood.

Overview of PM Fasal Bima Yojana (PMFBY)

The PMFBY is a crop insurance scheme that provides financial assistance to farmers in case of crop failure due to natural calamities. The scheme is implemented by the Ministry of Agriculture and Farmers Welfare, Government of India, and is available to all farmers across the country. The scheme’s primary objective is to provide a safety net to farmers, ensuring they are protected from crop losses and can continue to farm without fear of financial losses.

Understanding PMFBY 2024

PMFBY 2024 builds upon the success of previous years, offering financial security to farmers across India. Here’s a breakdown of the scheme’s key aspects:

Objectives:

- Provide financial support to farmers in case of crop loss.

- Stabilize farmers’ income and ensure agricultural continuity.

- Encourage adoption of innovative farming practices.

- Facilitate smooth credit flow in the agricultural sector.

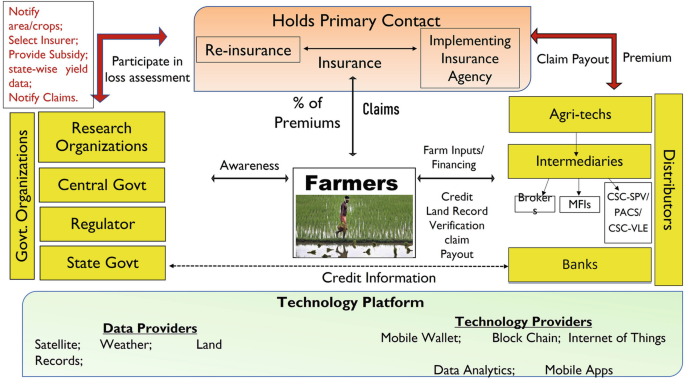

- Implementing Agencies: Insurance companies collaborate with state governments as implementing agencies for PMFBY.

- Covered Crops and Events: A wide range of crops (food grains, oilseeds, pulses, cotton, etc.) are insurable under PMFBY. The scheme covers losses arising due to:

- Natural calamities like floods, droughts, cyclones, etc.

- Pest and disease attacks

- Localized weather perils

MANAGEMENT OF THE SCHEME:

The existing State Level Co-ordination Committee on Crop Insurance (SLCCCI), SubCommittee to SLCCCI, District Level Monitoring Committee (DLMC) already overseeing the implementation & monitoring of the ongoing crop insurance schemes like National Agricultural Insurance Scheme (NAIS), Weather Based Crop Insurance Scheme(WBCIS), Modified National Agricultural Insurance Scheme(MNAIS) and Coconut Palm Insurance Scheme(CPIS) shall be responsible for proper management of the Scheme. IA shall be an active member of SLCCCI and District Level Monitoring Committee (DLMC) of the scheme.

How it Works?

- Insurance Coverage: PMFBY offers insurance coverage for various scenarios, including local natural calamities like landslides and hailstorms, yield losses due to floods, droughts, and pest infestations, and post-harvest losses caused by cyclones and unseasonal rains.

- Eligibility: Farmers cultivating notified crops in designated areas are eligible for coverage under PMFBY. The scheme covers a wide range of risks but does not protect against losses due to war, enmity, domestic or wild animals, nuclear risks, or malicious damage.

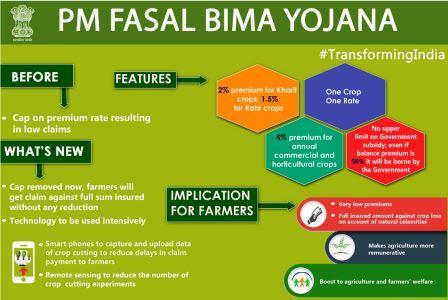

- Premium and Subsidies: Farmers pay a low premium of 2% for Kharif crops, 1.5% for Rabi crops, and 5% for annual commercial and horticultural crops. The government provides subsidies to cover the remaining premium amount, with no upper limit on subsidies. The scheme ensures that farmers receive claims against the full sum insured without reductions.

- Claims Settlement: PMFBY aims to expedite claims settlements through technological interventions like remote sensing, smartphones, and drones for accurate yield estimation. The use of technology helps reduce delays in claim payments to farmers and enhances the efficiency of the scheme.

- Revamping and Modifications: The scheme has undergone revisions to improve its effectiveness, including increasing the central government’s share in premium subsidies for northeastern states, promoting Information, Communication, and Education (ICE) activities, and providing flexibility to states in choosing risk covers and premium rates

Benefits

There are several benefits to farmers, including:

- Financial Assistance: The scheme provides financial assistance to farmers in case of crop failure, ensuring they can recover their losses and continue farming.

- Risk Management: PMFBY helps farmers manage risks associated with crop failure, providing them with a sense of security and stability.

- Increased Productivity: By providing financial assistance, the scheme encourages farmers to adopt modern farming practices, leading to increased productivity and better crop yields.

- Easy Application Process: The application process for PMFBY is simple and can be done online or offline, making it accessible to farmers across the country.

additional benefits

Yes, there are some additional benefits provided under the Pradhan Mantri Fasal Bima Yojana (PMFBY):

- Zero Premium for Farmers in North-Eastern States, Jammu & Kashmir, and Himachal Pradesh: The government pays the entire premium for farmers in these states, providing them with comprehensive coverage at no cost.

- Subsidies for Small and Marginal Farmers: The government subsidizes a portion of the premiums for small and marginal farmers, with the balance being paid by the farmers themselves.

- Comprehensive Coverage: PMFBY covers a wide range of crops, including food grains, oilseeds, horticultural crops, annual commercial/non-commercial crops, and plants and plantation crops, ensuring that a large number of farmers across the country can benefit from the scheme.

- Streamlined Claims Process: The government has implemented measures to streamline the claims process, such as using smartphones to capture and upload data of crop cutting to reduce delays in claim payments to farmers and using remote sensing to reduce the number of crop-cutting experiments.

- Grievance Redressal: In cases where farmers are not satisfied with the outcome of their claim or face issues with the claims process, they can file a complaint with the grievance cell established by the government.

These additional benefits, along with the low premium rates and comprehensive coverage, make PMFBY an attractive and supportive scheme for farmers across India.

Eligibility

eligibility criteria for the Pradhan Mantri Fasal Bima Yojana (PMFBY) are as follows:

- Farmers Covered: The scheme covers all farmers, including sharecroppers and tenant farmers, growing notified crops in designated areas.

- Loanee Farmers: For loanee farmers, PMFBY is mandatory to obtain crop loans or Kisan Credit Card (KCC) accounts for notified crops.

- Non-Loanee Farmers: Non-loanee farmers can also voluntarily opt for PMFBY coverage.

- Crop Coverage: The scheme covers food crops (cereals, millets, pulses), oilseeds, annual commercial/horticultural crops, and pilots for coverage of commercial/perennial horticultural crops with standard yield estimation methodology.

- Risks Covered: this scheme provides comprehensive risk coverage from pre-sowing to post-harvest stages against non-preventable natural risks, such as drought, dry spells, floods, inundation, pests and diseases, landslides, natural fire, cyclone, and hailstorm.

- Exclusions: The scheme excludes losses due to war, malicious damage, nuclear risks, and other preventable risks.

- Premium Rates: Farmers pay a nominal premium of 2% for Kharif crops, 1.5% for Rabi crops, and 5% for annual commercial/horticultural crops, with the government providing subsidies to cover the remaining premium amount.

it is an inclusive scheme that covers all farmers growing notified crops in designated areas, with affordable premiums and comprehensive risk coverage to support the agricultural sector and ensure the continuity of farming activities.

How to Apply

To enroll in the Pradhan Mantri Fasal Bima Yojana (PMFBY), farmers can follow these steps:

- Visit the PMFBY portal at https://pmfby.gov.in/ and click on the ‘Register’ tab to register themselves.

- Enter the required personal and official information, such as name, contact details, Aadhaar number, and bank account details.

- Verify the Aadhaar number (automatically verified) and mobile number (via OTP verification).

- Once the registration is approved, the farmer will be notified via SMS or email.

Alternatively, farmers can enroll in PMFBY offline by visiting their nearest bank branch or Common Service Centre (CSC). The offline process involves:

- Providing the required documents, such as identity proof, address proof, and land records.

- Paying the applicable premium amount based on the crop and sum insured.

- Obtaining a receipt or acknowledgment for the premium paid.

After successful enrollment, farmers will be covered under PMFBY for the notified crops in the designated area. The scheme provides comprehensive risk coverage from pre-sowing to post-harvest stages against non-preventable natural risks.

It is important for farmers to enroll in this scheme during the notified period for Kharif or Rabi seasons to avail of the benefits of the scheme.

Required Documents

To enroll, farmers need to provide the following documents:

- Bank account number

- Aadhaar card

- Khasra number of land

- Agreement photocopy

- Ration card

- Voter ID

- Driving license

- Passport-size photograph of the farmer, etc.

These documents are essential for the enrollment process in this scheme, ensuring that farmers can avail of the benefits of the crop insurance scheme effectively

Claim Settlement Process

The claim settlement process in the Pradhan Mantri Fasal Bima Yojana (PMFBY) involves several key steps to ensure that farmers receive compensation for crop losses in a timely and efficient manner. Here is an overview of the claim settlement process based on the provided sources:

- Intimation of Loss: Farmers must immediately notify the concerned authorities, such as the nearest Agriculture Department Office or the insurance company’s representative, within a specified time frame, generally within 72 hours of the occurrence of the loss.

- Submission of Documents: Farmers are required to submit a duly filled intimation form along with supporting documents, such as photographs of the damaged crop and a report from the village-level committee (VLC) or the agriculture department verifying the extent of loss.

- Crop Cutting Experiments (CCE): Designated agencies conduct Crop Cutting Experiments (CCE) to assess the actual crop yield and determine the extent of loss. These experiments involve randomly selecting sample fields and recording the crop yield, which is crucial for determining the compensation amount for the affected farmers.

- Loss Assessment: The Ministry of Agriculture & Farmers Welfare empanels evaluators to assess the losses and approve the claim request. The assessor will complete the assessment within stipulated timelines and finalize the assessment report to settle the claim.

- On-Account Payment: In cases of difficult seasonal conditions like prolonged dry spells, severe drought, floods, or unseasonal rains, the insurance agency may make on-account payments of claims. This process is carried out in consultation with the concerned State Government/UT based on satellite imagery, meteorological data, or other substitute indicators. Only 25% of likely claims are addressed through on-account payments, subject to specific conditions.

- Grievance Redressal: Farmers who are not satisfied with the outcome of their claim or face issues with the claims process can file a complaint with the grievance cell established by the government. The grievance cell is responsible for handling and resolving complaints related to this scheme.

By following these steps and actively participating in the claim settlement process, farmers can ensure a smooth and efficient process to receive compensation for crop losses.

what crops are covered?

The crops covered under the Pradhan Mantri Fasal Bima Yojana (PMFBY) include a variety of agricultural produce to ensure comprehensive protection for farmers. The scheme encompasses the following categories of crops:

- Food crops (Cereals, Millets, and Pulses)

- Oilseeds

- Annual Commercial crops

- Annual Horticultural crops

These crops are eligible for coverage under the PMFBY scheme, providing financial support and insurance against crop losses due to natural calamities, pests, and diseases. Farmers cultivating these crops in designated areas can benefit from the insurance coverage offered by PMFBY

what is the premium amount?

According to the search results, the premium amount for the Pradhan Mantri Fasal Bima Yojana (PMFBY) is as follows:

- For Kharif (summer) crops, the premium rate for farmers is 2% of the sum insured or the actuarial rate, whichever is lower.

- For Rabi (winter) crops, the premium rate for farmers is 1.5% of the sum insured or the actuarial rate, whichever is lower.

- For annual commercial/horticultural crops, the premium rate for farmers is 5% of the sum insured or the actuarial rate, whichever is lower.

The government provides subsidies to cover the remaining premium amount, with no upper limit on subsidies. The scheme ensures that farmers receive claims against the full sum insured without reductions.

Additionally, the search results mention that the premium rates are designed to be affordable for farmers, making the insurance scheme more accessible, especially for small and marginal farmers

Frequently Asked Questions (FAQs)

What is the maximum amount of financial assistance provided under this scheme?

The maximum amount of financial assistance provided under PMFBY is Rs. 2 lakh.

Is PMFBY available to all farmers in India?

A: Yes, PMFBY is available to all farmers in India, including small and marginal farmers.

Can I apply for PMFBY online?

A: Yes, farmers can apply for PMFBY online through the official website of PMFBY or by visiting their nearest Common Service Centre (CSC).

Conclusion

The PM Fasal Bima Yojana (PMFBY) is a critical initiative by the Government of India to support the agricultural sector. By providing financial assistance to farmers in case of crop failure, the scheme helps mitigate the risks associated with farming and ensures farmers can continue to farm without fear of financial losses. With its easy application process and comprehensive coverage, PMFBY is an essential safety net for Indian farmers.

Read More: National Digital Literacy Mission (NDLM)