Learn everything about Atal Pension Yojana (APY), a government-backed pension scheme in India for retirement income security. Eligibility, benefits, contributions, and FAQs explained.

The Atal Pension Yojana (APY) is a pension scheme introduced by the Government of India aimed at providing pension benefits to individuals in the unorganized sector. It was launched in 2015-16 to ensure a steady stream of income after the age of 60 for all citizens of India. The scheme is regulated by the Pension Funds Regulatory Authority of India (PFRDA) and is an extension of the National Pension Scheme, replacing the Swavalamban Pension Yojana.

Introduction

Planning for retirement is crucial, especially in India where a large portion of the workforce belongs to the unorganized sector with limited social security benefits. The Atal Pension Yojana (APY) is a government-backed initiative designed to address this very concern. Launched in 2015, APY offers a guaranteed minimum pension upon reaching the age of 60 years.

This article provides a comprehensive overview of the Atal Pension Yojana, including its eligibility criteria, benefits, contribution structure, and frequently asked questions. By understanding this pension scheme you can make informed decisions about your retirement planning and secure a financially secure future.

What is Atal Pension Yojana (APY)?

The Atal Pension Yojana is a voluntary, defined-contribution pension scheme offered by the Government of India. It caters primarily to workers in the unorganized sector, including:

- Self-employed individuals like farmers, carpenters, plumbers, electricians, and street vendors

- Workers in the gig economy

- Those not covered under employer-sponsored pension plans

Key Points about Atal Pension Yojana:

- Objective: The primary goal of the Atal Pension Yojana is to provide financial security in old age, especially for individuals in the unorganized sector.

- Eligibility: Any Indian citizen aged between 18 to 40 years can join the scheme.

- Contributions: The pension amount received at the age of 60 is based on the monthly contributions made by the individual and their age.

- Pension Options: Beneficiaries can choose to receive a periodic pension of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, or Rs. 5000, depending on their contributions.

- Co-Contribution: The Indian government provides co-contributions for accounts opened in the first year of the scheme for 5 years.

- Flexibility: Subscribers can increase or decrease their contributions once a year to adjust the pension amount.

- Beneficiaries: In case of the subscriber’s death, the spouse continues to receive pension benefits, and if both are deceased, the nominee receives the corpus amount.

How Atal Pension Yojana Works:

- Enrollment: Any Indian citizen aged 18 to 40 years with a savings bank account can enroll in the scheme.

- Contributions: Subscribers need to make regular monthly contributions based on the pension amount they desire.

- Pension Amount: The pension amount received at the age of 60 is determined by the contributions made during the subscription period.

- Beneficiary Options: Upon reaching 60 years, subscribers can choose to receive the pension amount or annuitize the corpus.

- Government Support: The government provides co-contributions for eligible subscribers for the first 5 years of the scheme.

- Flexibility: Subscribers can adjust their contributions annually to modify the pension amount as needed.

- Penalties: Failure to make timely contributions can lead to penalties, and early exits from the scheme have specific refund policies.

In conclusion, the Atal Pension Yojana is a significant initiative by the Indian government to ensure financial security for individuals in the unorganized sector during their retirement years. By encouraging regular savings and providing a structured pension scheme, it aims to alleviate financial burdens in old age and promote a sense of security among citizens.

Eligibility

To be eligible you must meet the following criteria:

- Be an Indian citizen

- Be aged between 18 and 40 years

- Possess a valid savings bank account or post office savings bank account

Benefits

Subscribing to Atal Pension Yojana offers several benefits, including:

- Guaranteed Minimum Pension: Upon reaching 60 years of age, Scheme provides a guaranteed minimum monthly pension ranging from Rs. 1,000 to Rs. 5,000, depending on your chosen contribution amount.

- Government Co-contribution: The Government of India co-contributes to yourpension account up to 50% of your monthly contribution, subject to a maximum of Rs. 1,000 per year. This co-contribution is available for those who join this pension scheme between the ages of 18 and 40 and is valid for the first five years of your subscription (as of May 2024).

- Tax Benefits: While contributions do not qualify for tax deductions under Section 80C of the Income Tax Act, the accumulated pension corpus and the pension received are exempt from taxes.

- Life Cover Benefit: In case of the subscriber’s unfortunate demise before reaching 60 years, the spouse will receive the accumulated pension corpus along with a monthly pension of the chosen amount. If the spouse is also no longer alive, the nominee will receive the accumulated corpus.

Contribution Structure in Atal Pension Yojana

The amount you contribute to this pension determines the minimum pension you will receive at retirement. The table below outlines the contribution options and corresponding pension amounts:

| Monthly Contribution (Rs.) | Guaranteed Minimum Pension (Rs.) |

| 40 | 1,000 |

| 80 | 2,000 |

| 120 | 3,000 |

| 160 | 4,000 |

| 200 | 5,000 |

Contributions can be made monthly, quarterly, or half-yearly through auto-debit from your linked savings bank account.

How is the pension amount calculated in Atal pension Yojana

To calculate the pension amount in the Atal Pension Yojana (APY), several factors come into play. The pension amount is determined based on the individual’s age at entry, the contribution amount made during the subscription period, and the chosen pension option. Here is how the pension amount is calculated in the Atal Pension Yojana:

- Age at Entry: The age at which an individual joins the Atal Pension Yojana plays a crucial role in determining the pension amount. Younger individuals who start contributing early tend to receive higher pension amounts upon maturity.

- Contribution Amount: The monthly contribution made by the subscriber is a key factor in calculating the pension amount. The pension amount increases with higher monthly contributions made over the subscription period.

- Pension Option: Subscribers can choose from different pension options ranging from Rs. 1000 to Rs. 5000 per month. The chosen pension amount directly impacts the total corpus accumulated and the monthly pension received after the age of 60.

- Government Co-Contribution: The government provides co-contributions for eligible subscribers for the first 5 years of the scheme, which can also influence the final pension amount.

- Return on Investment: The accumulated corpus, which includes the subscriber’s contributions, government contributions, and returns on investments, determines the pension amount that will be received monthly after the age of 60.

By considering these factors, individuals can use online calculators provided by various financial institutions to estimate their monthly contributions, total corpus, and the pension amount they can expect to receive under the Atal Pension Yojana. These calculators help in planning for a secure financial future and ensuring a steady income post-retirement.

What is the minimum and maximum pension amount in Atal pension yojana

The minimum and maximum pension amounts in the Atal Pension Yojana depend on the monthly contributions made by the subscribers. As per the information provided in the sources:

- Minimum Pension Amount: The guaranteed minimum pension under the this scheme can range from Rs. 1,000 to Rs. 5,000 per month, depending on the contributions made by the subscribers.

- Maximum Pension Amount: The maximum pension amount that can be received under the Atal Pension Yojana is Rs. 5,000 per month, which is the highest pension option available based on the contributions made by the subscribers.

These pension amounts are provided to subscribers when they reach the age of 60 years, ensuring a steady income stream post-retirement based on their contributions during the subscription period.

What happens to the pension amount after the death of the subscriber in atal pension yojana

After the death of the subscriber in the Atal Pension Yojana (APY), the pension amount is handled as follows based on the provided sources:

- Spouse’s Entitlement: In the event of the subscriber’s death before the age of 60, the spouse has two options. The spouse can either continue contributing to this pension account and receive benefits under it until the original subscriber would have turned 60 years old, or the entire accumulated corpus under APY will be returned to the spouse or nominee.

- Pension Continuation: If the spouse chooses to continue the APY account, they will receive the same pension amount as the subscriber until the spouse’s death. This ensures that the spouse continues to receive the pension benefits after the subscriber’s demise.

- Nominee’s Benefit: In case of the death of both the subscriber and the spouse, the nominee will receive the pension wealth accumulated until the subscriber’s 60th birthday. This ensures that the corpus amount is returned to the nominee in the absence of both the subscriber and the spouse.

Therefore, after the death of the subscriber in the Atal Pension Yojana, the spouse has the option to continue the account or receive the accumulated corpus, and in the absence of both the subscriber and the spouse, the nominee will receive the pension wealth.

process for nominating a spouse

To nominate a spouse in the Atal Pension Yojana, the process is as follows:

- If the subscriber is married at the time of joining APY, the spouse will automatically be the default nominee. The spouse’s details, including name and Aadhaar number, must be provided during enrollment.

- If the subscriber is unmarried at the time of joining, they can nominate any other person as the nominee. However, they will need to provide the spouse’s details after marriage.

- It is mandatory to provide nominee details, including the nominee’s name, relationship with the subscriber, and date of birth (if the nominee is a minor) during enrollment.

- In case of the subscriber’s death before the age of 60, the spouse has two options:Continue contributing to the Atal pension Yojana account until the subscriber would have turned 60 and receive the same pension amount as the subscriber until the spouse’s death.

- If both the subscriber and spouse are deceased, the nominee will receive the pension wealth accumulated until the subscriber’s 60th birthday.

Therefore, nominating the spouse is a crucial step in the Atal Pension Yojana, ensuring that the spouse or nominee receives the pension benefits in case of the subscriber’s demise before the age of 60.

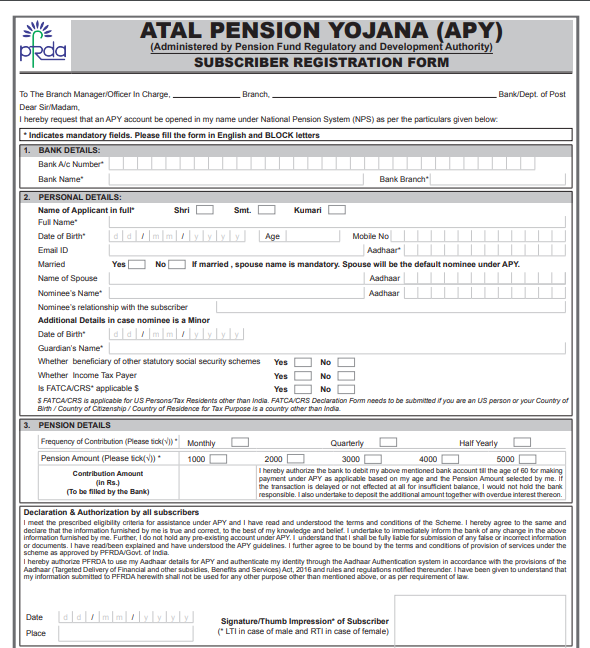

How to Apply

You can enroll for APY by visiting your nearest bank branch or post office that offers this pension services. The application process typically involves:

To apply for the Atal Pension Yojana , individuals can follow the steps outlined in the sources provided:

Apply through Branch:

- Visit the bank where you have an account.

- Visit the bank where you have an account.

- Collect the Atal Pension Yojana scheme form available in various languages.

- Fill up the application form with details such as bank account number, name, address, marital status, and the desired pension amount.

- Submit the completed form to the bank.

- If you have an account with the bank, your KYC details will be replicated from the bank account.

- Once the application is processed and the account is opened, you will receive an SMS on your registered mobile number confirming the activation of the scheme.

Apply Online

While there isn’t a completely online application process for Atal Pension Yojana as of May 21, 2024, there is a digital pre-registration option that can simplify the in-person enrollment process. Here’s a breakdown of the steps involved:

Pre-registration Online:

- Visit the National Pension System (NPS) website https://enps.nsdl.com/eNPS/NationalPensionSystem.html.

- Click on the “Online APY Subscriber Registration” link. You’ll find this under the “Atal Pension Yojana” section.

- On the registration page, fill out the required details, including:

- Bank Account Number and IFS Code

- Aadhaar Number (Mandatory to link with your mobile number for online registration)

- Email ID and Registered Mobile Number

- Last Digit of Aadhaar Number

- You can choose either to upload an Aadhaar Offline e-KYC XML file or enter a Share Code for paperless offline eKYC (if applicable).

- Complete the Captcha verification and submit the form.

- You’ll receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to confirm your registration.

Completing the Enrollment:

- After successful pre-registration, you’ll need to visit your bank branch or post office offering APY services.

- Carry the pre-registration acknowledgement slip (received online) along with your identity proof, address proof, and bank account details (if not already submitted during pre-registration).

- Inform the bank representative about your pre-registration and your intention to enroll.

- Select your desired pension amount and contribution frequency.

- You’ll likely need to fill out a physical application form for final verification.

- Once all documents are verified and the application is processed, your APY account will be activated, and you can begin making contributions.

Benefits of Pre-registration:

- Saves time at the bank branch by pre-filling your information.

- Simplifies the enrollment process by having your details readily available.

- Ensures a smoother transition from online pre-registration to in-person account activation.

Important Note: While online pre-registration streamlines the process, physically visiting a bank branch or post office remains mandatory to finalize your APY enrollment.

Required Documents

To nominate a spouse in the Atal Pension Yojana, the following documents are typically required based on the provided sources:

- Original Death Certificate of the Subscriber: This document is needed to verify the death of the subscriber, which triggers the process of transferring the pension benefits to the spouse or nominee.

- KYC of Spouse or Nominee: Know Your Customer (KYC) documents of the spouse or nominee are essential to establish their identity and relationship with the subscriber.

- Proof of Bank Details for Spouse or Nominee: Documentation confirming the bank account details of the spouse or nominee is necessary for the transfer of the pension wealth.

- Relationship Proof of Claimant with Subscriber: A legal heir certificate or a certified copy of a family member’s certificate issued by an Executive Magistrate indicating the relationship of the claimant with the subscriber may be required if the exit request is submitted by a claimant other than the spouse or nominee registered in the APY system.

These documents are crucial for the smooth processing of the nomination of a spouse in the Atal Pension Yojana and ensure that the pension benefits are transferred appropriately in case of the subscriber’s demise.

Important Points to Remember

- There is no exit option from APY before reaching the age of 60 years. However, in case of exceptional circumstances like terminal illness, you may be eligible for premature closure with a reduced pension amount.

- You can change your chosen pension amount during the subscription period, subject to certain conditions.

- It’s crucial to link your Aadhaar card with your APY account for smooth account management and future benefits.

FAQs

What is the minimum and maximum age for joining?

You can join between the ages of 18 and 40 years.

Is there a maximum income limit for eligibility?

No, there is no income limit for APY eligibility. However, the scheme is primarily targeted towards workers in the unorganized sector.

Can I continue contributing after reaching 60 years?

No, contributions to APY stop once you reach the age of 60 years. However, you will continue to receive the chosen pension amount until your death.

What happens if the subscriber dies after reaching 60 years?

The spouse will receive the chosen monthly pension amount for life. If the spouse is deceased, the nominee will receive the accumulated pension corpus.

Is there a nomination facility available?

Yes, you can nominate a beneficiary while enrolling. The nominee will receive the accumulated pension corpus in case of your and your spouse’s demise.

Where can I find more information?

You can visit the official website of the Pension Fund Regulatory and Development Authority (PFRDA) https://www.pfrda.org.in/myauth/admin/showimg.cshtml?ID=718 or your bank’s website for detailed information and application forms.

Will I get any tax benefits?

Tax benefits available under NPS scheme are also applicable as per Notification No. 7 /2016, F.No.173/394/2015-ITA-I dated 19th Feb, 2016. The Subscriber opting for new tax regime, may refer the provisions of new tax regime.

Conclusion

The Atal Pension Yojana provides a valuable safety net for individuals working in the unorganized sector in India. By offering a guaranteed minimum pension and potential government co-contribution, APY encourages regular savings and helps ensure financial security during retirement. While there are limitations like the pre-determined contribution options and no exit option before 60, the benefits outweigh these aspects for those seeking a secure retirement income.

Considering your age, if you are between 18 and 40, enrolling in Atal Pension Yojana now allows you to benefit from the scheme for a longer tenure, potentially maximizing your pension amount. Remember, starting early with even a modest contribution can significantly impact your retirement corpus.

Read More: Sponsorship and Foster Care Yojana